contra costa sales tax increase

Contra costa county saw a rise of roughly 35. So an underhanded legislative scheme was.

California Sales Tax Calculator And Local Rates 2021 Wise

Gavin Newsom signed into law a variety of bills on Thursday including SB1349 by State Senator Steve Glazer allowing a countywide half-cent sales tax.

. Online sales due to social distancing and in-store restrictions. You can see a list of all cities with. On the last day possible Gov.

Finally Measure X passage would leave at least seven Contra Costa city and town jurisdictions above the statutory 2 cap on local sales taxes. The Bay Area was. To build the countywide tax roll and allocate and account for property tax apportionments and assessments for all jurisdictions in.

It was approved. Gavin Newsom signed into law a variety of bills on Thursday including SB1349 by State Senator Steve Glazer allowing a countywide half-cent. Heres how contra costa countys maximum sales tax rate of 1075 compares to other counties around the united states.

That would bring Contra Costas sales-tax rate up to around 10 percent. City of Concord located in Contra Costa County 8750. The Contra Costa County California sales tax is 825 consisting of 600 California state sales tax and 225 Contra Costa County local sales taxesThe local sales tax consists of a.

On the last day possible Gov. So an underhanded legislative scheme was. The purpose of the Property Tax Division is.

The minimum combined 2022 sales tax rate for Contra Costa County California is. Finally Measure X passage would leave at least seven Contra Costa city and town jurisdictions above the statutory 2 cap on local sales taxes. Net of aberrations taxable sales for all of Contra Costa County grew 18 over the comparable time period.

The California state sales tax rate is currently. This is the total of state and county sales tax rates. City of San Rafael located in Marin County 9000.

36 rows Contra Costa County California Sales Tax Rate 2022 Up to 1075 The Contra Costa County. Contra Costa County Measure X was on the ballot as a referral in Contra Costa County on November 3 2020. Contra costa county collects a 225 local sales tax the maximum local sales tax allowed under california law contra costa county has a higher sales tax than 518 of.

Contra Costa County Measure X. 1 The city increased its existing tax of 050 percent CNCD to 100 percent CNTU in addition to the Contra Costa countywide increase of 050 percent listed in the countywide table. If it passes sales tax would increase by half a percent on most goods but not on necessities like food and medicine.

What You Should Know About Contra Costa County Transfer Tax

Funding Contra Costa Transportation Authority

Business Licenses El Cerrito Ca Official Website

California Sales Tax Rate Rates Calculator Avalara

Contra Costa County Treasurer Tax Collector Facebook

![]()

Sales Tax In California Ballotpedia

What Revenue Sources Meet Transit Riders Needs By San Francisco Transit Riders Medium

Yes People Are Leaving San Francisco After Decades Of Growth Is The City On The Decline

Midyear Budget Report A Reality Check Of Santa Cruz County S Finances Santa Cruz Sentinel

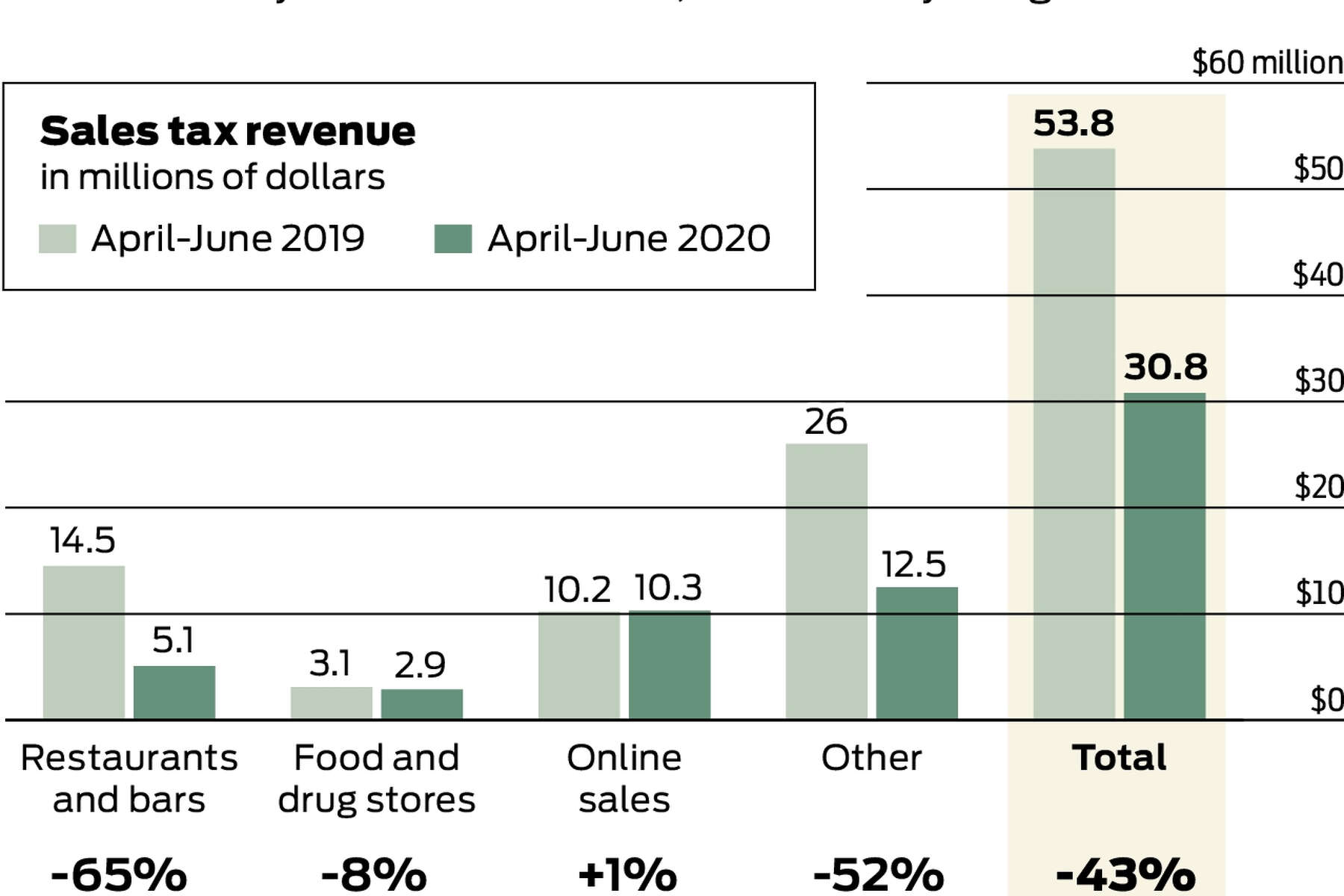

Sales Tax Revenue Increases For Lamorinda

Spain Recovery Plan More Tax Hikes Than Investment Projects

Plug In Electric Vehicles In California Wikipedia

Contra Costa County Treasurer Tax Collector Facebook

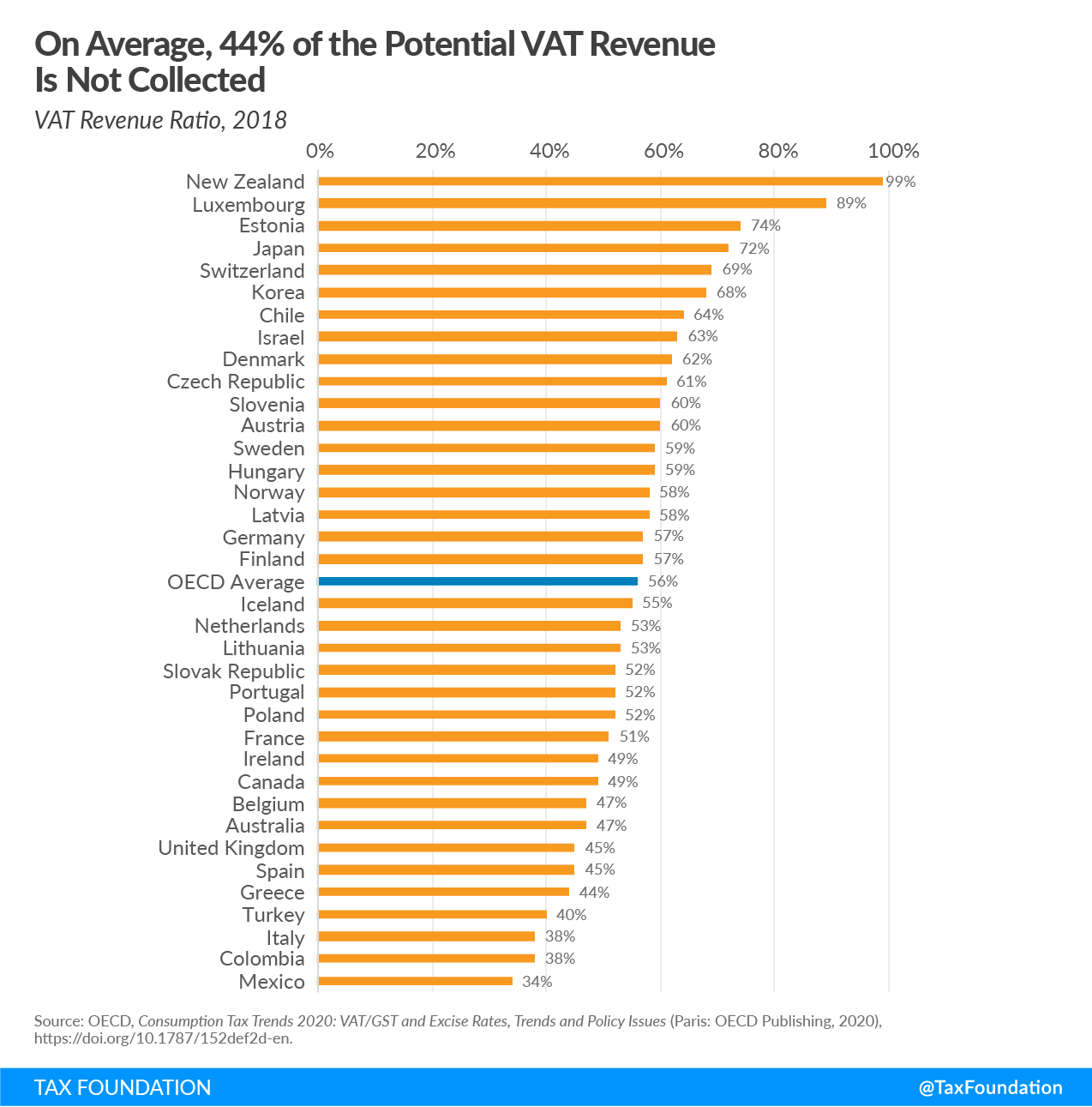

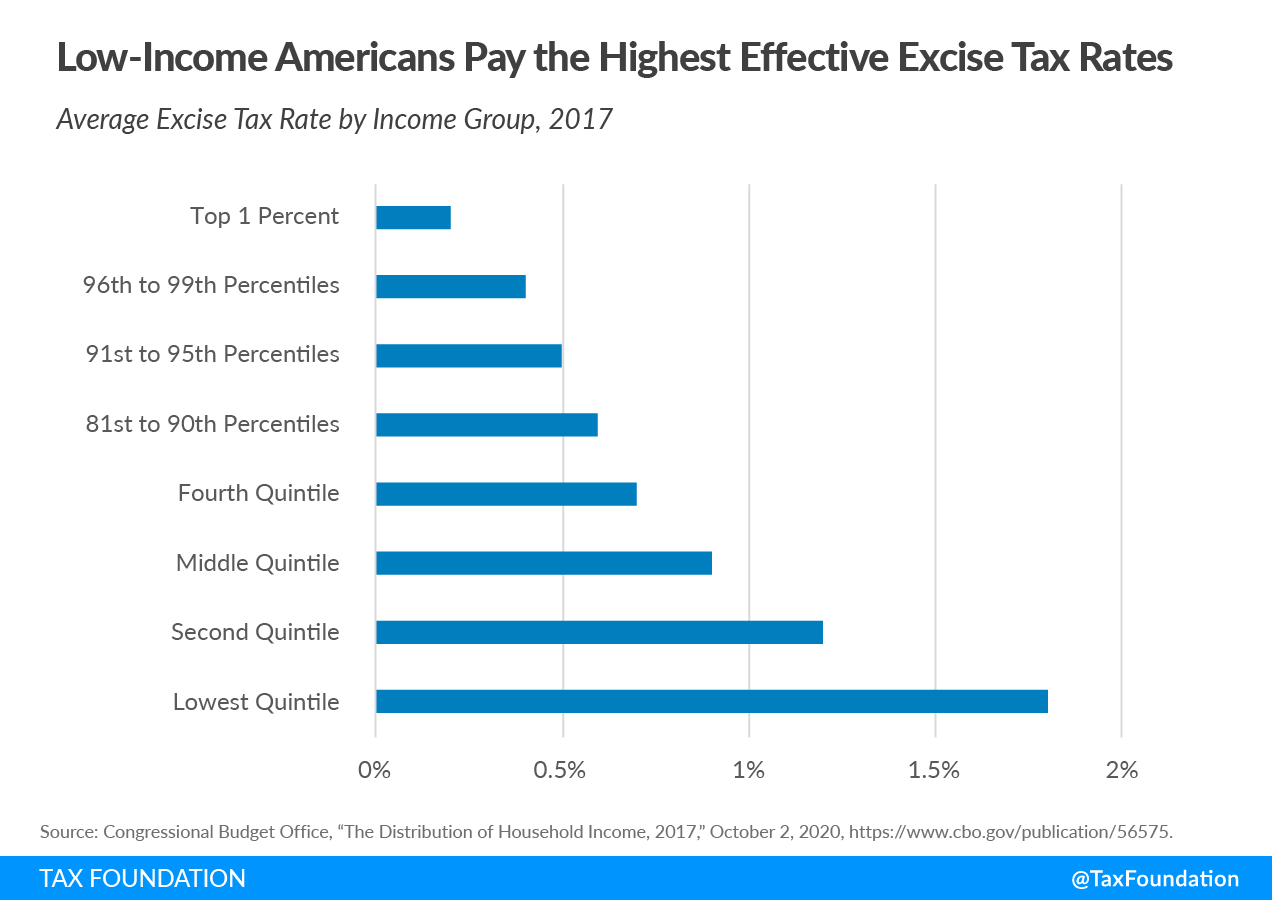

Excise Taxes Excise Tax Trends Tax Foundation

Cline Cellars Ancient Vines Zinfandel Contra Costa County Prices Stores Tasting Notes Market Data

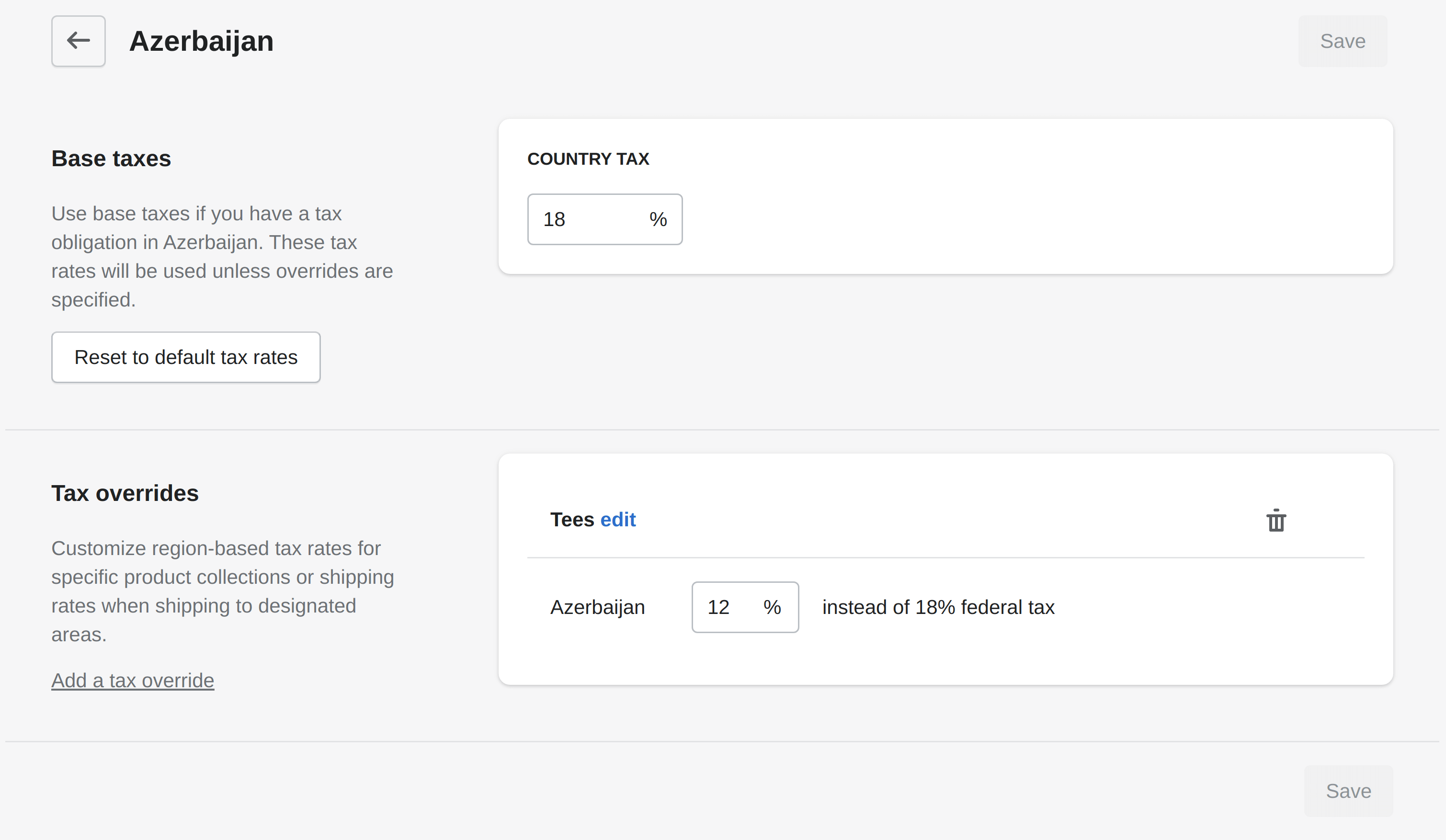

Shopify Sales Tax Report Step By Step Guide Self Service Bi Reporting Platform

Food And Sales Tax 2020 In California Heather

June 2021 Sales Tax Revenue Remains Low Compared To 2020 Pleasanton Express

Company Rates Stanislaus County In Top 10 Where Property Taxes Go Farthest Ceres Courier